Two weeks ago, the yield on the 10-year Treasury Note was hovering around 5%, and the S&P 500 was in contraction territory, down over 10%. But last week, the

Read More

The S&P 500 closed at 4,117 on Friday, more than 10% below its recent peak in late July. Some are saying it’s a brand-new bear market for stocks. In this view

Read More

We still think a recession is coming, but it definitely didn’t start in the third quarter. Instead, as we set out below, it looks like real GDP expanded at a 4

Read More

At the end of October we will get our first look at real GDP growth for the third quarter and it looks like it was very strong. We’ll have a more exact

Read More

Back in 2008, Ben Bernanke and Hank Paulson, using fear of financial collapse, convinced President Bush and Congress to 1) pass a $700 billion bailout of banks

Read More

The fiscal year ended last week, alarms went off both literally and figuratively, and a last-minute deal was reached to keep the government open for another

Read More

We have plenty of data reports to go, but, so far, the third quarter is shaping up to be a strong one for the US economy. The Atlanta Fed’s GDP Now model is

Read More

A month ago, many people were pretty sure serious inflation concerns had passed. After the equivalent of 22 quarter-point rate hikes and the biggest drop in

Read More

Back in the 1980s, President Reagan took enormous political heat (Sam Donaldson comes to mind) for being fiscally irresponsible. His offense? Presiding over a

Read More

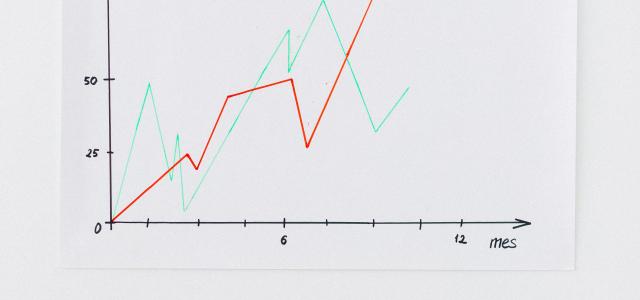

At the heart of our assessment of the stock market is our Capitalized Profits Model.

That model takes economy-wide profits (excluding profits or losses

Read More

What’s going on with the markets and the economy? Long-term Treasury yields are up substantially since last Fall while the stock market, after a big rally, has

Read More

Wars cost money, and throughout history countries have borrowed to fight them. There are plenty of examples of wars bankrupting countries, but the US was so

Read More